Colosseum’s 2024 Investments and Themes for 2025

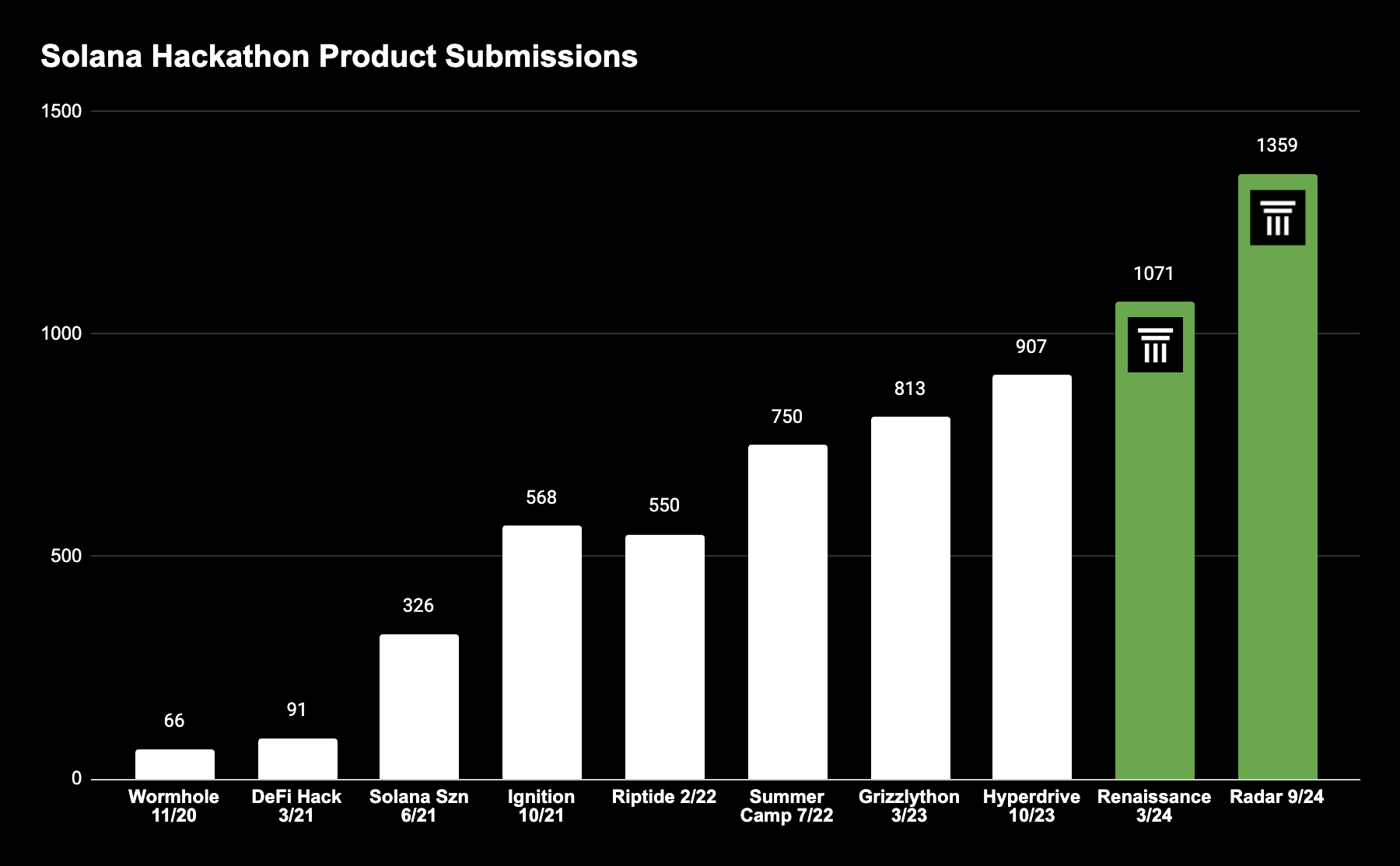

We launched Colosseum in early 2024 with the goal of empowering developers to compete, experiment, and build products across a broad spectrum of crypto use cases through our online hackathons. In partnership with the Solana Foundation and numerous ecosystem organizations, we’ve built the largest hackathons in crypto and helped accelerate the rapid growth of Solana’s startup ecosystem.

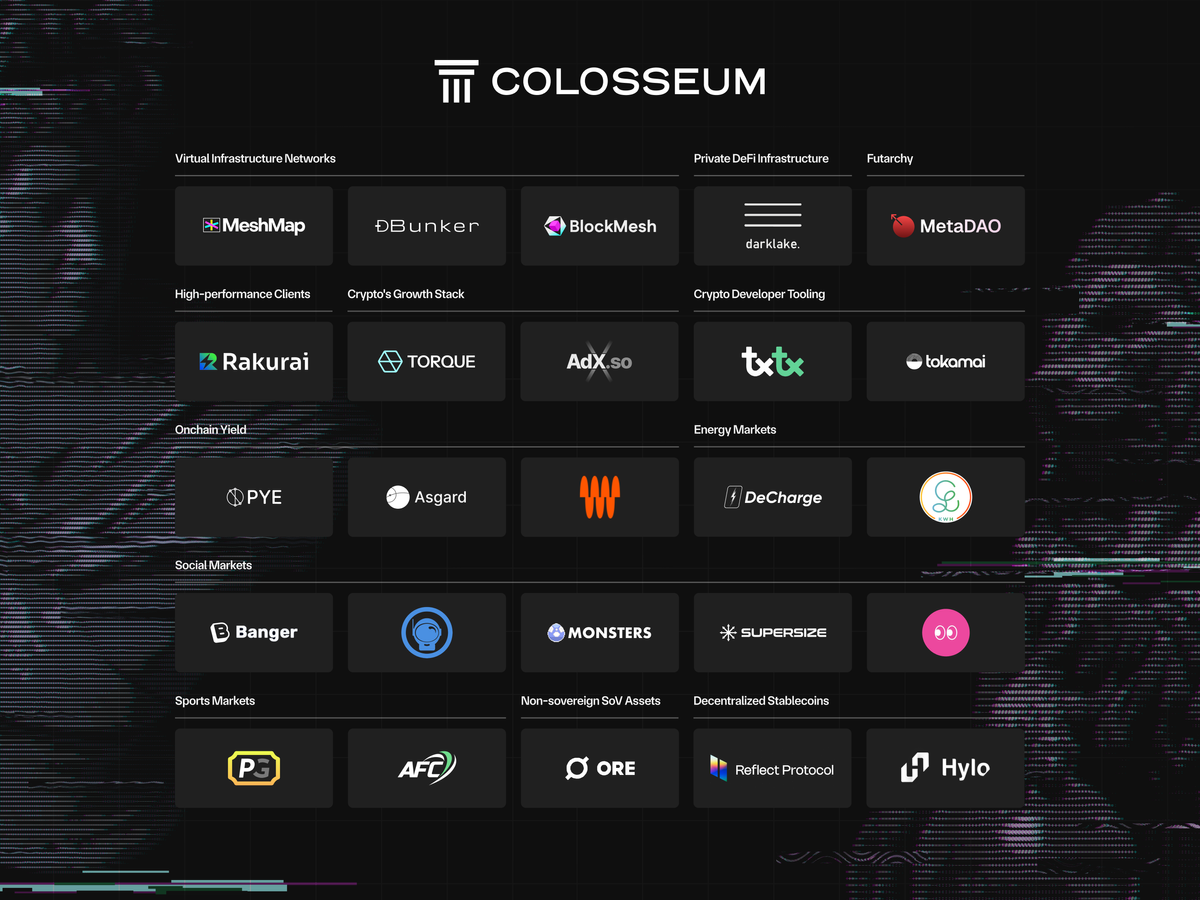

Following each major Solana hackathon (Renaissance and Radar), we accepted two accelerator batches each with 10+ winning teams. And to date, we’ve made pre-seed investments in 20+ startups. Reviewing thousands of hackathon submissions and working with talented founders in our accelerator program has given us an up close view of crypto's rapidly emerging markets. As the year comes to a close, we’re excited to share our perspective on 12 high-growth verticals where we saw exciting development in 2024, and that we believe will continue to shape the crypto landscape in 2025. In addition, we highlight the hackathon winners and teams we’ve backed who we believe are creating the markets that will drive each category forward.

Note: Many of the projects mentioned below are currently on devnet, with mainnet deployments expected in Q1 and Q2 2025.

Non-Sovereign SoV Assets

Over the past decade, Bitcoin has proven that a non-sovereign store-of-value (SoV) asset can gain global acceptance and secure a core position within the global financial system. While Bitcoin’s incredible success validated the concept, we believe it also opened the door for additional digital gold-like assets to reach escape velocity and meaningful liquidity in the coming years.

Ore stands out as the most promising non-sovereign asset tailored specifically for onchain ecosystems. Strong community support, thoughtful economic design, and increased liquidity—fueled by “Boosts” on key trading pairs—positioned Ore well in 2024. We’re excited to see the core team use these structural advantages to build new products that further its adoption in the broader onchain economy.

Futarchy

DAOs have long struggled with governance, often relying on 1-token-1-vote structures that can stifle progress, resulting in a waste of both human and treasury capital. MetaDAO offers a transformative “futarchy as a service” framework, enabling organizations to make decisions through markets rather than traditional voting mechanisms.

MetaDAO is already integrated into leading projects like Drift and Jito. We believe futarchy will continue to solidify itself as the default governance module in the Solana ecosystem (and crypto more broadly) in 2025—one that overcomes entrenched governance challenges and accelerates dynamic decision-making.

Decentralized Stablecoins

Stablecoins like USDC and USDT have achieved widespread adoption, and crypto-native products such as Ethena are also on the rise. However, existing stablecoin implementations often sacrifice censorship resistance, capital efficiency, or both.

A new wave of experimentation is underway, with the aim of creating stablecoins that offer robust stability while also delivering more decentralization, transparency, and higher yield potential. Reflect and Hylo represent two of the most promising protocols leading the decentralized stablecoin renaissance in 2025.

Crypto’s Growth Stack

As consumer-facing products begin to dominate venture funding in the Solana ecosystem, the need for sophisticated growth tools will increase in lockstep. Just as Web2 startups have grown up around powerful analytics and marketing tools, Web3 builders are now developing their own data-driven growth engines to meet their unique needs.

Torque is one such product, providing a powerful onchain-native growth platform, enabling just-in-time user rewards based on a wide variety of behaviors. Prominent teams like Tensor and Metaplex already use Torque for targeted growth campaigns. Meanwhile AdX, a team in our latest accelerator cohort, is building a decentralized ad exchange, granting both Web 2 and Web 3 projects direct access to effective distribution channels.

High-performance Clients

Currently, Solana’s network relies on two main node clients: Anza’s Agave and Jump’s Firedancer, the latter of which hasn’t been fully deployed yet. The Firedancer team has taken on the ambitious (and critical) effort of building a new client from the ground up, with a focus on high-performance. While we believe this will be a successful effort over the coming years, we also believe there are sustainable opportunities for monetizing more tightly-scoped validator improvements even sooner.

Rakurai, a team of experienced engineers from Apple and high-frequency trading, are capitalizing on one such opportunity. Building on upcoming Agave releases, their validator client will integrate an optimized transaction scheduler that has benchmarked at up to 5x the current block rewards and yield boosts of over 30% compared to existing clients. We anticipate a continued increase in competition amongst validator operators, leading to better network performance for apps and users in the years to come.

Crypto Developer Tooling

As crypto matures, development teams require increasingly advanced tooling to secure, monitor, and scale their products. In traditional tech, tools like HashiCorp’s Terraform made cloud infrastructure management far simpler and more reliable for engineers. In crypto, Txtx is poised to offer similarly transformative infrastructure—improving security, reliability, and reproducibility of workflows involving onchain programs/smart contracts.

For monitoring and rapid bug resolution, Tokamai has also emerged as a crypto-native equivalent to Sentry, empowering developers to maintain application reliability through every layer of the stack.

Onchain Yield

While DeFi has introduced overcollateralized lending, capital-efficient yield remains elusive. The next phase of DeFi will bring more sophisticated yield markets onchain, enabled through true prime brokerage-like functionality and liquid staking fundamentals.

Asgard is laying this groundwork by building a suite of DeFi protocols, including a spot margin aggregator and credit synthesizer. Pye, another hackathon winner, is creating a marketplace that allows stakers to tokenize and forward-sell their staking yield—further extending the frontier of DeFi 2.0.

The final team we backed in this vertical is Watt, which is building a volatility farming protocol utilizing market arbitrage to generate real yield for users and foster liquidity for the ecosystem as a whole.

Private DeFi Infrastructure

Transparency is a defining feature of DeFi, yet certain market participants prefer selective privacy. PayPal’s integration of confidential transactions using token extensions for its PYUSD stablecoin highlights a growing demand for privacy-enhanced financial infrastructure.

We believe this foreshadows in a new era of embedded privacy primitives for DeFi. Darklake, a recent hackathon standout, employs zero-knowledge proofs to create a privacy-first dark pool trading platform.

Sports Markets

Sports are rapidly financializing: stadiums are integrating casinos, online betting is thriving, and college athletes are now receiving substantial compensation. Crypto is poised to expand and democratize these markets—enabling direct ownership, unique betting models, and new forms of engagement.

In our newest accelerator cohort, AlphaFC is pioneering the tokenization of sports fandom through real ownership of an English football club, and Pregame is building a new platform for direct p2p sports betting. We're excited to watch both of these endeavors expand crypto’s role in the sports economy.

Virtual Infrastructure Networks

DeVINs (Decentralized Virtual Infrastructure Networks) gained momentum in 2024 and we continue to see top founder talent launch a diversity of products in the space.

BlockMesh empowers users to earn passive income by leveraging their unused bandwidth, and is well on their way to building a strong network with over 500,000 extension downloads. Meanwhile, MeshMap is focused on building a 3D AR mapping network. Although mainstream AR/VR adoption is still in its infancy, we anticipate accelerated growth in these areas over the next 1-2 years. Finally, we also backed DBunker, which is an aggregator and marketplace giving users the ability to participate across many DeVINs.

Energy Markets

Rising global energy demand and increasing climate pressures create volatility and opportunity. Southeast Asia, in particular, has seen high demand for innovative solutions to support a growing population with an aging energy grid. We’ve backed 2 India-based teams who are building novel token-incentivized infrastructure to serve this demand.

DeCharge has deployed over 150 EV charging stations within just a few months, and is expanding to the U.S. in Q1 2025, and GreenkWh is using battery packs to coordinate off-grid energy—both projects exemplify how crypto can reshape global energy infrastructure.

Social Markets

After a 2024 boom in memecoins, founders are now exploring deeper integrations of social media, token issuance, and gaming. The following teams are exploring use cases across a spectrum of community engagement to gamified token economies:

- Banger: An app that enables users to buy and sell “tweet tokens,” Curators to profit from high-volume tweet markets, and Creators to earn for their viral posts.

- Peek: A platform that leverages liquid crypto markets to gamify TikTok videos and content.

- Supersize: A Mini-clip style gaming platform building an onchain PVP game where token communities wager and compete for dominance to become the largest “blob” on the map.

- Monsters: A new game for memecoin communities, blending Pokémon-inspired mechanics with high-stakes betting.

- Teamplay (with Midcurve): A platform for creators to host private gaming sessions and contests, tightening community engagement and opening new revenue streams through a token-enhancing toolkit.

Looking Ahead

As we prepare to run more hackathons for the Solana ecosystem in 2025, we’re eager to learn from the next generation of founders and support the creation of novel crypto markets. One emerging force we’re closely examining is AI weaving its way into crypto landscape. While we don’t view AI as a standalone use case, we do see it as a transformative layer that will enhance all verticals.

Sign up at colosseum.org to get notified about our upcoming hackathons—we can’t wait to see what you build next!